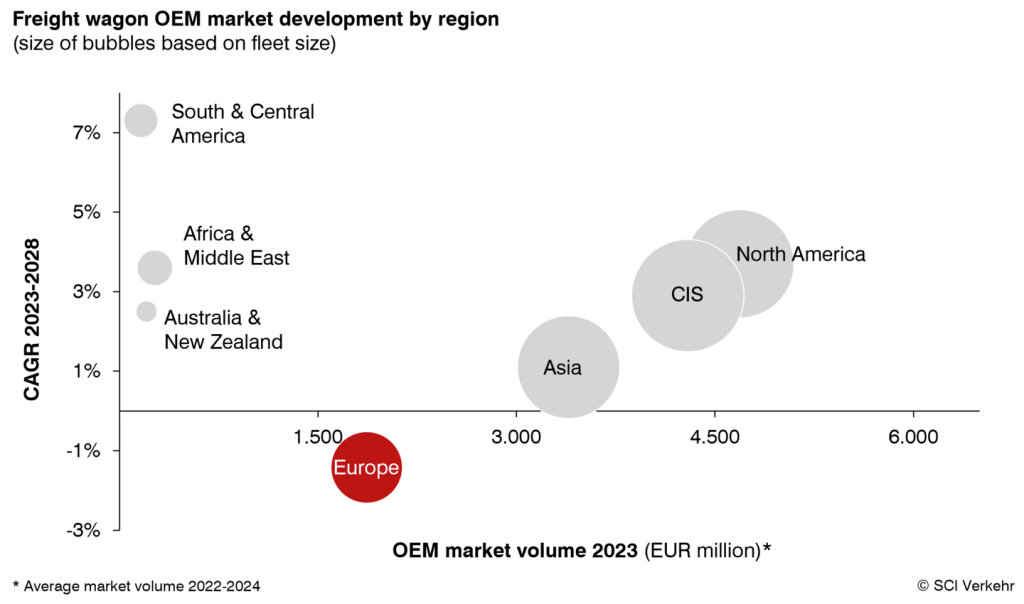

The global freight wagon market is set to continue growing over the next four years, but regional disparities will see Europe fall behind according to new data from rail consultancy SCI Verkehr.

The company’s ‘Freight Wagons – Global Market Trends 2024’ report predicted a 2.6% annual growth rate between 2024 and 2028 for both the global OEM market and after-sales sector for freight wagons, but said the European market could see a decline amid a weakened economy.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

SCI Verkehr said: “Even though production capacities are well utilised for both 2024 and 2025 thanks to existing contracts, the freight wagon industry in Europe is feeling the effects of challenges within the rail freight market.

“The intermodal wagon sector is particularly affected. The previously high demand for container and pocket wagons – key contributors to the market’s substantial volume in the past two years – has now collapsed due to decreased transport demand.”

According to the study, the issues seen in the European market will start to come to a head in the second half of 2025 when the industry will begin to see its decline, despite positive signs in the alternative wagon type sectors, such as car-carrying wagons.

While Europe is expected to see a decline over the projection period, the freight wagon markets in all other regions are expected to grow by 2028, with North America’s market returning to growth of around 3% after a period of decline.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

The strongest growth will be seen in the South and Central American market according to SCI Verkehr, with the region projected to see an annual growth rate of more than 7%, a significantly better rate than Africa and the Middle East, which is predicted to have the second-best growth at around 3.5%.

The issues highlighted in the report reflect the complaints made by freight operators in the European market in recent years, with operators calling for more government support to address increasing costs related to electrification and track access charges.

In March, a report from the Netherlands’ national rail infrastructure manager ProRail found that the country’s rail freight traffic was down 10% in 2023, while in the UK, the government has published a 75% growth target for the freight industry by 2050 after a series of job cuts and calls for help from the industry.