A recent webinar, run by the International Railway Summit, has discussed the Rail Baltica megaproject’s potential as a driver the post-Covid European recovery and its development as part of a wider European framework.

During the conference call, both EU policymakers and those directly involved with Rail Baltica presented the project’s latest plans, developments and opportunities for the future. Below are three lessons that we learned from the event.

Rail Baltica will drive post-Covid recovery and development

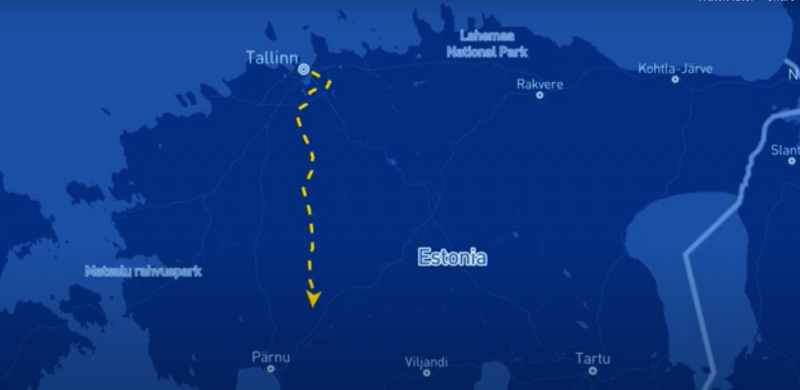

Rail Baltica is one of Europe’s largest megaprojects, as it aims to connect the Baltic region and the north-east of Europe to the EU’s network via 870km of greenfield railway infrastructure.

The project – which involves the construction of seven international stations in the Baltics, connecting them to central and western Europe – will see the direct involvement of Estonia, Latvia and Lithuania, as well as participation from other European partners.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAccording to Rail Baltica head of strategy and development Kaspars Briškens, the project will help revive the post-Covid European economy, both in the short and long-term.

“Rail Baltica is turning out to be an excellent showcase of how Europe and global partners are coming together to help deliver a wonderful greenfield project,” he said.

Not only will the network create 13,000 direct jobs as well as 24,000 indirect ones, but with a €6bn investment, the project will drive a sustainable economic recovery, in line with the European Green Deal.

Rail Baltica will also be a driver of post-Covid recovery because it has contributed to the resilience and robustness of the rail supply chain during the lockdown.

“Rail Baltica has allowed companies to maintain operations during the pandemic, because a project like Rail Baltica hasn’t stopped, but also to promote the ability to return to normal operations, post disruption,” Briškens explained.

Other long-term and quantifiable benefits include environmental benefits, travel safety and an increasing reduction of noise and travel time.

Non-quantifiable advantages, on the other hand, will include industrial and regional development, economic integration and digitalisation.

In order to maximise the potential of a project such as Rail Baltica, said Briškens, there need to be some prerequisites, including the need to capture the greenfield opportunity.

Delivering a multimodal ecosystem of different infrastructures and a ‘dig once’ approach – which consists of building other infrastructures at the same time as the railway network – will be fundamental for the success of the project.

Rail Baltica is part of a wider European project to develop a sustainable railway network

On a European level, the Rail Baltica project fits into the TEN-T, a European Commission’s policy which aims to develop a Europe-wide sustainable network of railway lines, road, ports and airports.

TEN-T, whose core network of railways will cost €500bn and will be developed by 2030, includes nine multimodal corridors, including the North Sea-Baltic Corridor, of which Rail Baltica is a fundamental component.

According to Herald Ruijters, director of investment at the European Commission’s Directorate-General for Mobility and Transport, TEN-T will complete the European internal market by ensuring physical connections between member states and tackling missing links.

The policy will also increase mobility by focusing on sustainable solutions and boost economic growth by facilitating transport and business opportunities across the EU.

In this framework, Ruijters explained, Rail Baltic fits perfectly as it is considered a missing link. The system, which received 3bn from Brussels, is a geostrategic opportunity to connect the eastern part of the Baltic Sea to Western Europe, integrating them within the EU framework.

Ruijters added that the railway system will connect capital cities with ports and strategic objects, mobilise disadvantaged regions, and contribute to the European Green Deal by creating a shift in long-distance traffic.

TEN-T projects such as Rail Baltica are also important on a military level, as €1.5bn has been allocated to military mobility to facilitate the movement of military troops and assets.

“We are not going to invest only in military mobility, that is not our role,” he said. “But where this infrastructure can benefit both civilians and the military at the same time, we would do so.”

Some products can be manufactured locally while others need to be developed by external companies

Advisory company Tüv Süd provided Rail Baltica with a supplier market study, to help Rail Baltica choose the best manufacturers for the project.

“The main scope was to deliver to Rail Baltica a really objective impression of what the market is for track components around Europe and internationally,” said Tüv Süd rail infrastructure global head Valentina Monaco.

The study’s criteria posed Latvia’s capital Riga as the centre of evaluation for the study, as it is situated in the middle of the three Baltic countries. To find appropriate suppliers, Tüv Süd experts defined a radius of distance from Riga, dividing it into four subcategories.

‘Low radius’ involved all manufacturers within 500km of Riga, while the medium category ranged between 500km and 1,000km. The medium-high category expanded between 1,000km and 1,500km, while high radius was defined as being over 1,500km of distance.

The radius measurements were then used for the benchmarking of typical track components, including rails, turnouts and sleepers.

The study’s outcomes showed that, despite a few exceptions, competitive manufacturers are present in the region.

With regards to rail, the study showed that manufacturers were primarily outside the region but within the maximum radius distance, while Baltic countries offered a good turnout for manufacturers, as well as market leaders. Overall, the Baltic region offered good competitors, said Monaco.

Sleeper manufacturers are also present in the Baltic region but most of them are not able to produce the required products at the moment, but they are willing to update their production mechanisms.

“This [study] was a good step in realising that there are different situations for different components,” explained Monaco.