The European Commission (EC) has given conditional clearance for Alstom’s acquisition of Bombardier Transportation.

The approval for the acquisition is subject to the compliance with commitments package provided by Alstom.

EC executive vice-president Margrethe Vestager said: “Thanks to the comprehensive remedies offered to solve the competition concerns in the areas of very high-speed, mainline trains and mainline signalling, the EC has been able to speedily review and approve this transaction.

“Going forward, a stronger combined Alstom and Bombardier entity will emerge. At the same time, thanks to these remedies, the new company will also continue to be challenged in its core markets to the benefit of European customers and consumers.”

In February, Bombardier and Caisse de dépôt et placement du Québec (CDPQ) signed a memorandum of understanding (MoU) to sell the former’s rail business to Alstom.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThis acquisition will make Alstom the second largest manufacturers after China’s CRRC Corporation.

Earlier this month, Alstom announced plans to carry out divestments of products and factories ahead of the acquisition in a bid to receive regulatory approval.

The EC previously expressed concerns regarding the French rolling stock manufacturer’s larger market presence after the acquisition.

However, the EC investigation stated that the transaction did not present any competition concerns in other markets, particularly the mainline and urban signalling.

EC added that the position of Bombardier in the mainline and urban signalling sector in the European Economic Area (EEA) is limited.

According to the proposed engagements, Alstom will transfer the contribution of Bombardier Transportation to the V300 ZEFIRO very high-speed train.

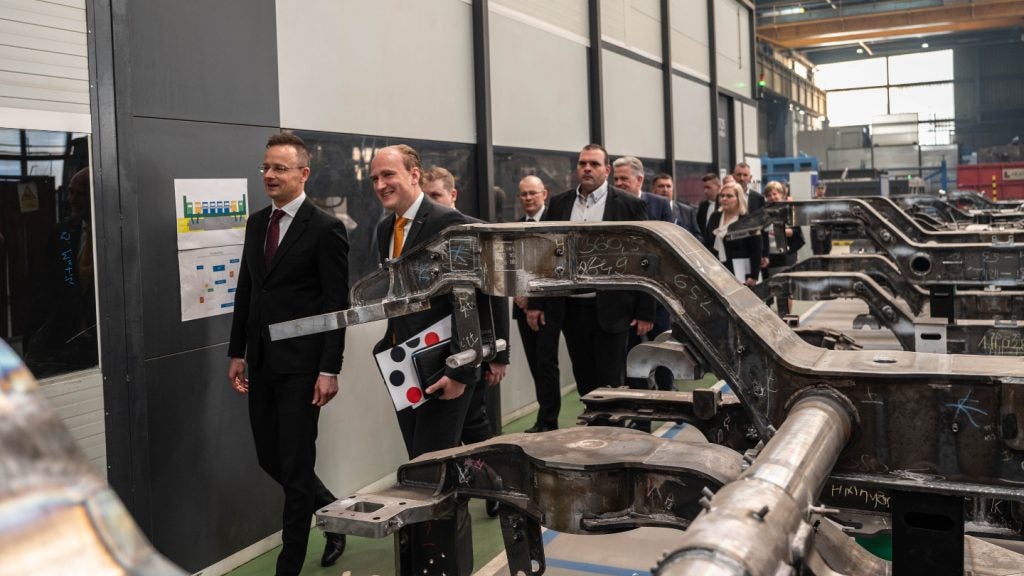

The company will also divest Alstom Coradia Polyvalent, the Reichshoffen production site in France, the Bombardier TALENT 3 platform and production facilities within the site in Hennigsdorf, Germany.

Alstom will also provide access to some interfaces and products for several signalling on-board units and train control management systems (TCMS) of Bombardier Transportation.

Additionally, the company will offer the IP licence to Hitachi for the train developed by both Hitachi and Bombardier Transportation. The train is expected to be used in the future for very high-speed tenders in the UK.

The divestitures planned by Alstom will adhere to the social processes and consultations with employee representatives’ bodies.

The acquisition is yet to receive further regulatory approvals in many other jurisdictions and other closing conditions.

Alstom expects the acquisition to close in the first half of next year.